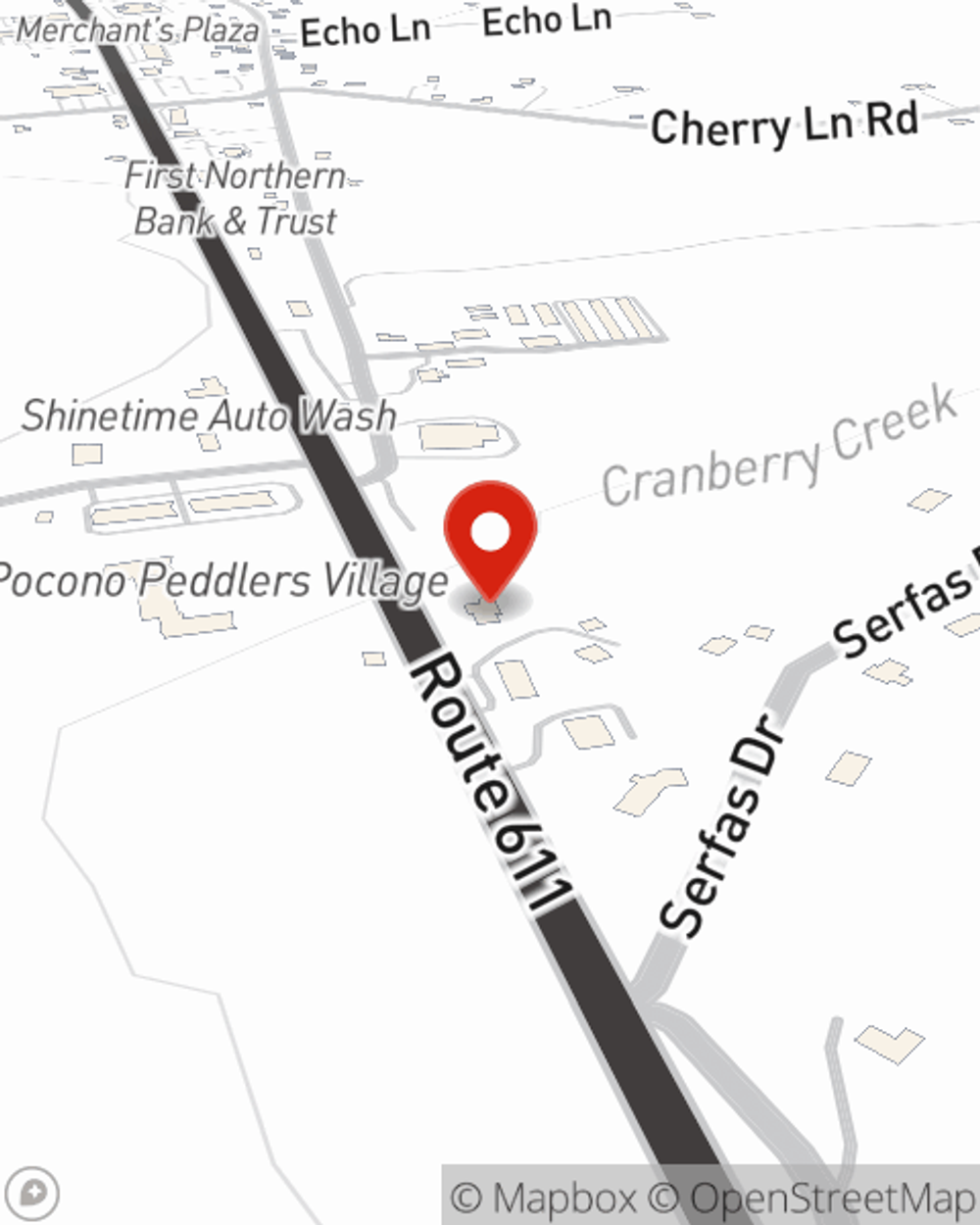

Auto Insurance in and around Stroudsburg

Auto owners of Stroudsburg, State Farm has you covered

Insurance that won't drive you up a wall

Would you like to create a personalized auto quote?

Be Prepared For The Accidents Of Life

With State Farm, you can drive with confidence knowing your auto coverage is dependable and reliable. With plenty of savings programs including Safe Driver Program and Multiple Automobiles, you could maximize your eligible savings. Not sure which savings options you can get? Joe Ronco can work with you to with a personalized quote.

Auto owners of Stroudsburg, State Farm has you covered

Insurance that won't drive you up a wall

Get Auto Coverage You Can Trust

With State Farm, get revved up for terrific auto coverage and savings options like car rental and travel expenses coverage uninsured motor vehicle coverage, an older vehicle passive restraint safety feature discount accident-free driving record savings, and more!

So don’t let vandalism or fender benders stop you from living on the go!

Have More Questions About Auto Insurance?

Call Joe at (570) 534-4800 or visit our FAQ page.

Simple Insights®

What is telematics and how is it used?

What is telematics and how is it used?

Learn what telematics means, how driving data like speed and mileage is collected via devices or apps and how it's used in usage-based auto insurance programs.

What happens if I am not at fault in a car accident?

What happens if I am not at fault in a car accident?

Learn how to file an insurance claim after a not at fault car accident. Understand third-party vs first-party claims, deductibles and subrogation.

Simple Insights®

What is telematics and how is it used?

What is telematics and how is it used?

Learn what telematics means, how driving data like speed and mileage is collected via devices or apps and how it's used in usage-based auto insurance programs.

What happens if I am not at fault in a car accident?

What happens if I am not at fault in a car accident?

Learn how to file an insurance claim after a not at fault car accident. Understand third-party vs first-party claims, deductibles and subrogation.